How to Use Shopping Portals And Dining Programs to Earn More Points

Last Updated on February 26, 2023 by Jarrod West

Traveling and using travel credit cards isn’t the only way to rack up points and miles for your next trip. If you’re like most people, you do plenty of online shopping and enjoy dining out at restaurants. Fortunately, thanks to shopping and dining portals, you can earn even more points for the products you were going to buy or the place you were going to eat anyway.

Let’s have a look at how shopping and dining portals work, along with the options that are available to you.

Shopping Portals

Going through a shopping portal before purchasing an item you were planning to purchase anyway is an excellent way to earn some extra points and miles. Often times you can earn anywhere between 3x-10x points/miles per $1 spent with hundreds of merchants like Apple, Nike, Adidas, etc., and this is in addition to the points on miles you’ll earn with your credit card.

If you’re wondering which shopping portals are available to you, here is a list of all the active airline, hotel, and bank program shopping portals.<

| Loyalty Program | Shopping Portal |

| Alaska Airlines | Mileage Plan Shopping |

| American Airlines | AAdvantage eShopping |

| American Express | Rakuten* |

| Barclaycard | Rewards Boost* |

| British Airways | Executive Club eStore |

| Chase | Ultimate Rewards Shopping* |

| Choice Privileges | Online Mall |

| Delta Air Lines | SkyMiles Shopping |

| JetBlue Airways | TrueBlue Shopping |

| Spirit Airlines | Online Mall |

| Southwest Airlines | Rapid Rewards Shopping |

| United Airlines | MileagePlus Shopping |

| Wells Fargo | Earn More Mall* |

| Wyndham Rewards | Shop and Earn |

You must have an eligible credit card from the bank program in order to earn rewards.

As you can see, there is plenty of options to choose from depending on the type of points that you prefer to earn. One thing to keep in mind is that, for the bank reward shopping programs (American Express, Barclaycard, Chase, and Wells Fargo), you can only earn points with that program if you have an eligible card issued by that bank. Whereas all other programs can be utilized regardless of the card you use to pay.

Rakuten – My Favorite Shopping Portal

Of all the programs listed above, Rakuten is by far my favorite to use, and here is why:

- Rakuten allows you to earn Amex Membership Rewards points instead of cash-back if you have an eligible card

- Rakuten regularly runs double cash-back/points promotions, and includes coupons or promo codes during checkout.

- With over 2,500 store partnerships, they almost always include the store I’m planning to shop with.

- Shopping in person? Rakuten offers in-store cash-back too when you link a card to the program.

Whether you prefer American Express Membership Rewards points, or cash-back, I can’t recommend Rakuten highly enough. If you’ve never used Rakuten before you can earn $30 in cash-back, or 3,000 Amex Membership Rewards points, when you sign up and spend $30 within the first 90 days of your membership.

Cashback Monitor

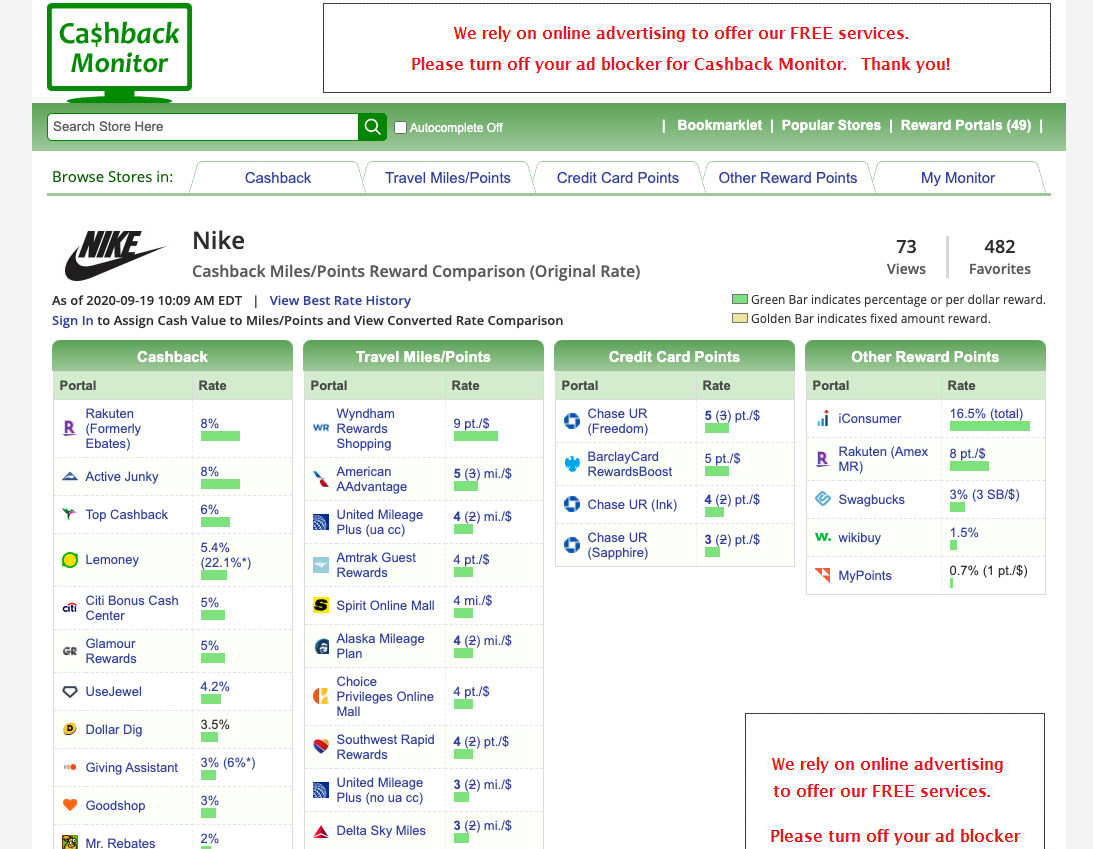

For the savviest of deal seekers among us, or for those who prefer to earn the most points possible, regardless of the type of point, then you should be using Cashback Monitor.

With Cashback Monitor, simply search for the store you’re shopping with, and you will see the cash-back or point rates that you can earn with dozens of different programs. This way you can compare and contrast the earn rates across programs to make sure you’re always getting the best deal.

Dining Programs

Dining programs are another excellent way to earn extra miles and points for something you were planning to do anyway. Simply link your card to the program, go out to eat as you normally would, pay for the meal with the linked card, and you can earn points or miles in one of the following programs.

| Loyalty Program | Dining Program | Points Earned |

| Alaska Airlines | MileagePlan Dining | Earn 0.5-5 miles per $1 |

| American Airlines | AAdvantage Dining | Earn 1-5 miles per $1 |

| Delta Air Lines | SkyMiles Dining | Earn 1-5 miles per $1 |

| Hilton | Honors Dining | Earn 2-8 points per $1 |

| Intercontinental Hotels | Rewards Club Dining | Earn 1-8 points per $1 |

| JetBlue Airways | TrueBlue Dining | Earn 3 points per $1 |

| Marriott | Eat Around Town | Earn 4-6 points per $1 |

| Spirit Airlines | Free Spirit Dining | Earn 1-5 miles per $1 |

| Southwest Airlines | Rapid Rewards Dining | Earn 1-3 points per $1 |

| United Airlines | MileagePlus Dining | Earn 1-5 miles per $1 |

Each of these programs has membership tiers that allow you to earn more points per $1 for simply opting in to receiving email communications or dining out a certain number of times. So you’ll almost always be able to earn at least 3 miles or points per $1 spent.

So which program is right for you? That depends on the type of points you’d like to earn and the restaurants that are available in each program. I recommend picking a program that offers points or miles that you know you will have a use for, and includes restaurants that you visit semi-frequently.

Keep in mind that, unlike shopping portals, you can only have one credit card linked to any given dining program. So if you have your American Express Gold card linked to the Marriott Eat Around Town program, it cannot also be linked to the SkyMiles Dining program. However, if you want to participate in multiple programs you can always link multiple credit cards.

Final Thoughts

Simply put, if you’re not utilizing shopping portals when purchasing items, or dining programs when you go out to eat, you’re missing out on some serious points that you could be racking up! Each transaction might feel inconsequential in terms of the number of points you earn, but your points can add up much quicker than you’d expect. All of those online purchases and trips out to eat could end up amounting to a free flight or hotel stay by the end of the year!